What is real estate syndication?

Real estate syndication (or belongings syndication) is a partnership among numerous buyers. They integrate their skills, sources, and capital to buy and control a belongings they in any other case could not afford.

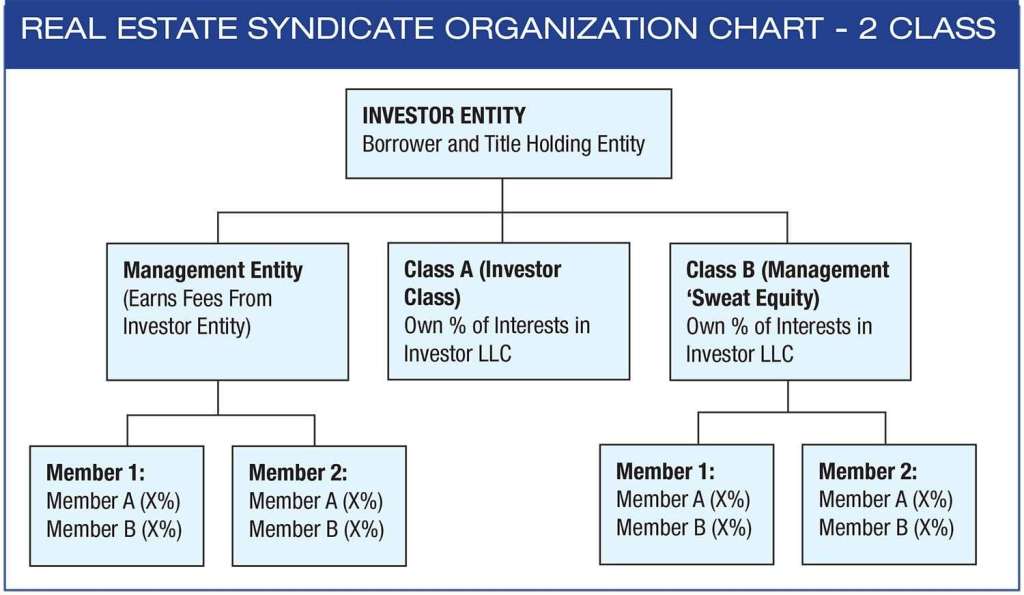

There are generally roles in belongings syndication: syndicator and investor. The syndicator is likewise referred to as the sponsor.

Your skills, abilities, wherewithal, and quantity of to be had capital decide which you’re satisfactory appropriate for.

Choose your function carefully

If you are splendid at scouting and dealing with houses however have little capital, a function as syndicator may match satisfactory. The sponsor scouts and secures the belongings with an agreement and generally manages the funding as well. Sometimes the sponsor will installed a touch little bit of cash (perhaps five%–10%) at the same time as different instances their contribution is solely with inside the shape of time and effort.

It’s everyday for the syndicator to earn an acquisition charge, which is basically a commission, for bringing with inside the deal. This charge varies however averages round 1%.

Other participants of the deal offer the cash to purchase, renovate, or function the belongings. Once it is stabilized or offered in a predetermined go out strategy, the syndication is complete. Those participants assume to have a passive function wherein they make investments their coins and get hold of a month-to-month or quarterly go back.

Whether the sponsor installed cash or not, she or he additionally receives a bit of the deal. But earlier than getting paid, the sponsors provide the opposite buyers an annual “desired go back” as excessive as 10%. Also Check – Useful recommendations for purchasing a foreclosed belongings

There are many approaches to break up the profits

Let’s examine an example. You’re a sponsor who secured an condominium constructing for $1 million. There are 4 buyers who every installed $250,000, however all 5 of you’ve got got agreed to very own 20% of the deal.

The organization has agreed to pay you a 1 question charge of $10,000. The constructing’s annual internet running income is $80,000. You pay a desired go back of five% to every of the buyers who installed coins, which is $12,500 every, or $50,000 total. You break up the remaining $30,000 5 approaches, which is $6,000 every.

For the buyers, that is a 7.4% annual go back on their cash. That’s on pinnacle of any appreciation of the belongings they might coins in on whilst it is offered. As the sponsor, you’ve made $16,000 with out installing any of your very own coins.

This situation assumes you pay for third-celebration belongings control. If you, the sponsor, control the belongings, you can gather a control charge primarily based totally on rents.

Let’s say the organization consents to pay you to gather rents, behavior constructing maintenance, pay the bills, and maintain the constructing in correct shape. They’ll come up with a 10% control charge on $120,000 gross income. That’s $12,000 similarly to the $6,000 you’ve earned as a go back. Related – What Is a Timeshare and How Does It Work?

Now believe that, in 5 years, the organization consents to promote the belongings for $1.five million. You and the buyers percentage the $500,000 advantage 5 approaches, every making $100,000 similarly to their coins flows for the final 5 years.

Of course, you don’t must break up returns equally. You would possibly do a 70% percentage to the passive buyers and a 30% break up to you because the sponsor. Or 80/20. Or 50/50. It’s as much as the syndicator and buyers to negotiate. It can be associated with how lots paintings you probably did to accumulate and control the funding.

If the belongings wishes a number of paintings while you purchase it, and you may control it yourself, you ought to take a larger percentage of the profits. You would possibly want to evict tenants, cope with late maintenance, or spruce up devices to lead them to extra appealing to ability tenants. That’s certainly really well worth extra income.